|

|

|

#1901 |

|

College Starter

Join Date: Oct 2000

Location: Pittsburgh, PA

|

As someone who worked in consumer banking for a long time, Citi doesn't surprise me. They definitely skew more affluent / private banking that would exceed the $250k mark plus as you mentioned business banking. Bank of America has more of a consumer focus.

Goldman also is surprising to be low.

__________________

"It's a great day for hockey" - "Badger" Bob Johnson |

|

|

|

|

|

#1902 | |

|

Hall Of Famer

Join Date: Jun 2006

Location: Chicago, IL

|

Quote:

There is also a little less publicized lending program that is going to bailout the other banks. The Fed is buying up the banks' losing position on bonds at par valuation. So it'll clean up those unrealized losses and prevent any runs on the banks. Federal Reserve Board - Federal Reserve Board announces it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors This is worse than bailing out depositors at SVB who torpedoed their own bank. It's a really weird time. There was so much political backlash from the 2008 bailouts that the Fed has to do some creative solutions to make bailouts not look like bailouts to the public. |

|

|

|

|

|

|

#1903 |

|

World Champion Mis-speller

Join Date: Nov 2000

Location: Covington, Ga.

|

"The new Fed program will enable banks to pledge U.S. Treasuries and other safe government securities as collateral in return for loans of up to one year from the central bank."

Yup, that sounds risky. Sent from my SM-G996U using Tapatalk |

|

|

|

|

|

#1904 |

|

Hall Of Famer

Join Date: Jun 2006

Location: Chicago, IL

|

It's not risky. It just lets banks get out of bad investments. An advantage none of us would receive.

|

|

|

|

|

|

#1905 | |

|

Head Coach

Join Date: Oct 2005

|

The article pdf has more details on BTFP

Quote:

|

|

|

|

|

|

|

#1906 | |

|

Head Coach

Join Date: Oct 2005

|

I don't know/understand all the words or implications of the words, but here's CNBC.

https://www.cnbc.com/2023/03/13/wall...ef-plans-.html Quote:

I'll wait for more detailed analysis on BFTP but I'm seeing it as Fed adding more liquidity in case the situation escalates more. Which is a good thing. Last edited by Edward64 : 03-13-2023 at 05:49 PM. |

|

|

|

|

|

|

#1907 |

|

Hall Of Famer

Join Date: Jun 2006

Location: Chicago, IL

|

Allowing banks to use their losing positions to borrow at par and not market value is a bailout. Makes the whole bond market pointless.

It does say eligible collateral has to have been owned by March 12th, so banks can't exploit it too much and keep buying shitty bonds to flip into cash. But at some point the government has to let these banks win or lose on their own. |

|

|

|

|

|

#1908 | |

|

Head Coach

Join Date: Oct 2005

|

More inflation metrics coming out Tue & Wed.

I'm sure Jerome is praying it'll be lower than expected so he can ease up on rates. If its worse than expected, he (& committee) will have a key decision to make. Quote:

|

|

|

|

|

|

|

#1909 |

|

Head Coach

Join Date: Oct 2005

|

I was wondering if SVB, Signature and Republic went through the ballyhooed Fed "stress" tests.

According to below pdf (see pg 13/66), nope. https://www.federalreserve.gov/publi...s-20220623.pdf Unsure why but assume SVB with $200B deposits wasn't deemed important/significant (?) enough. Last edited by Edward64 : 03-13-2023 at 06:43 PM. |

|

|

|

|

|

#1910 |

|

Hall Of Famer

Join Date: Jun 2006

Location: Chicago, IL

|

The 2018 banking deregulation bill uppsed the amount to $250 billion before you had to be stress tested.

|

|

|

|

|

|

#1911 | |||

|

Head Coach

Join Date: Oct 2005

|

Quote:

Quote:

Quote:

|

|||

|

|

|

|

|

#1912 | |

|

Head Coach

Join Date: Oct 2005

|

I've read about CS weakness for a while now, even before this current mess. In wiki, said it had $1.6T in assets. I'm thinking it's too big to fail for Switzerland.

Quote:

|

|

|

|

|

|

|

#1913 |

|

Head Coach

Join Date: Oct 2000

Location: North Carolina

|

I can't find the article, but I remember someone writing back when rates started rising (and were clearly going to rise for a while) that portions of the economy had become used to cheap money and that it was papering over fundamental unsoundness and that we'd see some surprising failures over the next few years.

I wish I'd saved that article so I could send the author a "I'd like to subscribe to your newsletter" message. |

|

|

|

|

|

#1914 | |

|

Head Coach

Join Date: Oct 2005

|

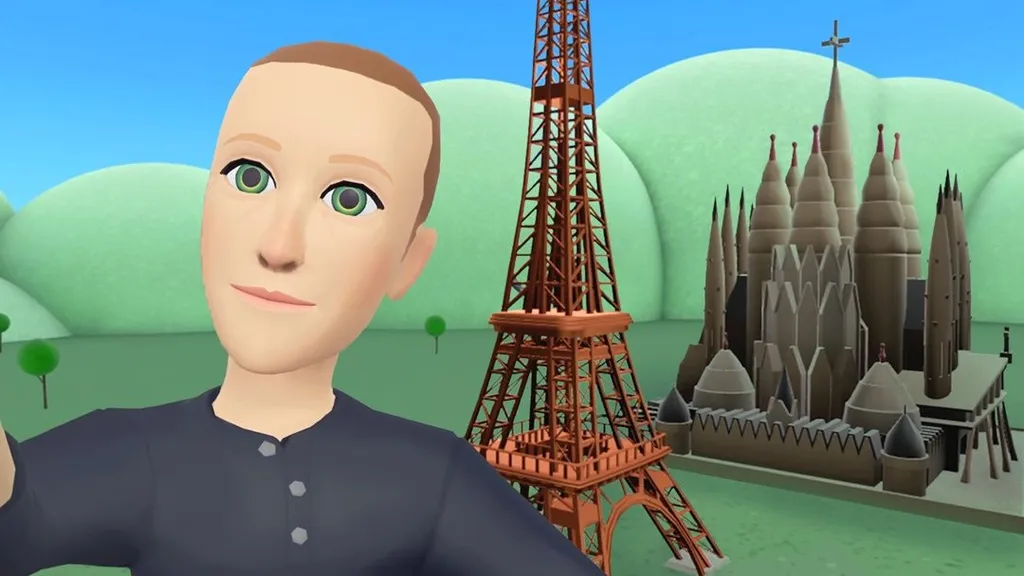

Good move Zuckerberg. I think Meta is on or near survival mode to show long term viability, relevance.

https://www.cnbc.com/2023/03/14/meta...ructuring.html Quote:

Be sure the let go the folks responsible for spending $10B of your money for your avatar.  Last edited by Edward64 : 03-14-2023 at 09:41 AM. |

|

|

|

|

|

|

#1915 |

|

Hall Of Famer

Join Date: Jun 2006

Location: Chicago, IL

|

Imagine celebrating 10,000 people losing their job because a company that is still wildly profitable, didn't make enough profits for their shareholders. Just sociopathic behavior.

|

|

|

|

|

|

#1916 |

|

Head Coach

Join Date: Oct 2005

|

So what would you propose that Meta do?

Last edited by Edward64 : 03-14-2023 at 05:48 PM. |

|

|

|

|

|

#1917 |

|

Hall Of Famer

Join Date: Jun 2006

Location: Chicago, IL

|

I don't know. I wouldn't be celebrating 10,000 people losing their jobs as some kind of good thing. It's not a fucking video game.

|

|

|

|

|

|

#1918 |

|

Head Coach

Join Date: Oct 2005

|

Okay, I guess you can read my comment that way.

I read it as celebrating Meta acknowledging they have to do something, make hard decisions to ‘right the ship’ |

|

|

|

|

|

#1919 |

|

Hall Of Famer

Join Date: Jun 2006

Location: Chicago, IL

|

Maybe the way to "right the ship" is to get rid of the man who set it off course and came up with one of the dumbest ideas in the history of tech.

Meta made $23 billion in net profit last year in case people think they are failing or whatever. |

|

|

|

|

|

#1920 |

|

World Champion Mis-speller

Join Date: Nov 2000

Location: Covington, Ga.

|

But you see, without these people, they could have made $23.3 billion dollars.

Sent from my SM-G996U using Tapatalk |

|

|

|

|

|

#1921 |

|

Head Coach

Join Date: Oct 2005

|

I actually don’t disagree about getting rid of Zuckerberg, but what is one to do as he is the major shareholder and that’s prob not realistic.

There’s many smarter people than you and me that do believe Meta is failing. If you have any other ideas, I’m sure he’ll be willing to listen. Last edited by Edward64 : 03-14-2023 at 07:03 PM. |

|

|

|

|

|

#1922 |

|

Hall Of Famer

Join Date: Jun 2006

Location: Chicago, IL

|

Basically, I think it's weird to say "Good move Zuckerberg" at firing 10,000 people because the company only made $23 billion in profits last year. Just a basic human decency thing.

|

|

|

|

|

|

#1923 |

|

Hall Of Famer

Join Date: Jun 2006

Location: Chicago, IL

|

The palpable silence from the tech crowd that said we needed to bailout SVB depositors because it would lead to job loss. Wonder why they aren't upset about these layoffs.

|

|

|

|

|

|

#1924 | |

|

Head Coach

Join Date: Oct 2005

|

Quote:

I’d say that I said ‘Good move at firing 10,000 people because you know shareholders expect hard decisions to be made to help Meta stop the slide to irrelevance’. Sure $23B is impressive but that’s a drop of 69% from the prior year. And the downward trend is continuing unless he rights the ship. So yeah, he needs to stop the bleeding because $23B won’t go that far for Meta. Last edited by Edward64 : 03-14-2023 at 07:51 PM. |

|

|

|

|

|

|

#1925 | |

|

Head Coach

Join Date: Oct 2005

|

Quote:

I’m just talking about Meta. But if you want to discuss SVB (and the problems, imperfections of capitalism) that IMO is a separate discussion. |

|

|

|

|

|

|

#1926 | |

|

Head Coach

Join Date: Jul 2001

|

Quote:

The poors are just commodities to people like Edward, to be hired/fired/used/abused at the feet of the important people, the shareholders. So what if a few million can't have homes, or food, as long as the stock price goes up. |

|

|

|

|

|

|

#1927 | |

|

Head Coach

Join Date: Oct 2005

|

Quote:

Not sure who the 10,000 are but suspect most of them, make more money than you or me (or used to). Let’s not paint them as ‘the poors’. If anything, the are better suited to find jobs than most people. Ultimately, if Meta can’t right the ship, there’ll be more layoffs. So fire Zuckerberg if you can, no issues from me, but I don’t see how layoffs aren’t part of the solution. |

|

|

|

|

|

|

#1928 |

|

Coordinator

Join Date: Sep 2004

Location: Chicagoland

|

If those 10,000 people make a lot of money (and be assured, a lot of them aren't developers, and thus don't), that money also supports many support industries like cleaners, food service, etc.... A lot of those people will lose their jobs as well.

|

|

|

|

|

|

#1929 | |

|

Coordinator

Join Date: Sep 2004

Location: Chicagoland

|

Quote:

The non-sociopathic choice would be to use some of that $23B in net profit to cushion the blow of unemployement for those let go (and the networks of much lower-wage workers they support). Yes, I'm sure Meta needs to change and restructure. Many companies do and have. Why is it always acceptable, in these situations, for said companies to still be making obscene profit during the transition period that sees so many lives completely upturned. The only reason the idea of using some of that $23B in net profit to cushion the blow of unemployement* seems so crazy is because this country is so in thrall to the sociopathic principles of capitalism that any call to not maximize profits goes against our national psyche. *and I'm not talking about 16 weeks severance and health insurance for 6 months, I'm talking half a year severance and a year of health insurance at a minimum. Again, $23B in net profit. |

|

|

|

|

|

|

#1930 | |||

|

Head Coach

Join Date: Oct 2005

|

Quote:

What's your logic? Why not 1 year of severance or 2 years of health? Here's a comp with other Tech giants. How Tech Giants' Severance Packages Stack up: Google, Microsoft, Amazon I think Meta is pretty competitive. Plus Meta had given additional 2 weeks of severance pay per year of service. So someone working there for 5 years hits your 26 weeks of severance (base of 16 + (5 x 2). Basically, their 2022 severance package was pretty good comparatively speaking. Just for reference, googled on banks (including Goldman Sachs) https://www.efinancialcareers.com/ne...-severance-pay Quote:

Quote:

I don't understand above quote. They are definitely using some of the $23B to cushion the blow, it's expected and it's not so crazy. Last edited by Edward64 : 03-14-2023 at 10:10 PM. |

|||

|

|

|

|

|

#1931 | ||

|

Head Coach

Join Date: Oct 2005

|

Quote:

Sure. There is no info on the breakdown so I said "suspect most of them". I am willing to bet the vast majority of them will be the white collar workers vs the support cleaners, food service. It wouldn't surprise me if many of the cleaners and food service are 3rd party contractors (e.g. not employees). When I googled, the average & mean varied from site to site so take below FWIW Just a moment... Quote:

BTW - I'm okay with moving this discussion to another thread, creating a new one, or stopping. If I don't hear back to the contrary, I'll assume it's a group decision (well at least between RM and me) to continue Last edited by Edward64 : 03-14-2023 at 10:18 PM. |

||

|

|

|

|

|

#1932 |

|

Hall Of Famer

Join Date: Jun 2006

Location: Chicago, IL

|

Simping for Mark Zuckerberg of all people.

|

|

|

|

|

|

#1933 |

|

Head Coach

Join Date: Oct 2005

|

I guess that’s the end of the discussion. Come back anytime

|

|

|

|

|

|

#1934 | |||

|

Head Coach

Join Date: Oct 2005

|

Quote:

There's going to be some pain today in the financial markets. It will be interesting to see how Swiss citizens react to the CS crisis and if there'll be a big enough of a run where the Swiss Fed equivalent has to step in. Switzerland is not part of the EU so not sure what help will come from there. Quote:

I tried but was unsuccessful finding an article on which companies or economies have the biggest CS risk. More of a global presence than SVB or Signature so more of global impact. But found how much the Swiss Feds guarantee (Swiss Franc is CHF and roughly 1 to 1.1 with USD). Quote:

Last edited by Edward64 : 03-15-2023 at 07:53 AM. |

|||

|

|

|

|

|

#1935 |

|

Head Coach

Join Date: Oct 2005

|

Interesting to me. In a lot of pics of the NYSE floor, you see the old guy with the glasses and beard. Peter Tuchman

I've started seeing more pics of her in MSM  |

|

|

|

|

|

#1936 | ||||||

|

Head Coach

Join Date: Oct 2005

|

Quote:

CNN had a good writeup in layman's terms on BTFP. Premarket stocks: The forgotten rescue plan that could prevent another SVB-like collapse | CNN Business Quote:

(Article used an example of $1000 bond worth $600. I don't know if that's representative or just purely illustrative. I think, hope it's the latter) The purpose Quote:

Quote:

Quote:

Quote:

Last edited by Edward64 : 03-15-2023 at 09:29 AM. |

||||||

|

|

|

|

|

#1937 | ||

|

Head Coach

Join Date: Oct 2005

|

Without the current bank mess, the lower than expected PPI would have been pretty good for the markets. Oh well. I think this gives Jerome some breathing room to not up rates hike to .5%+ and to keep them at .25% or 0 this month, and buy some time for the markets to settle some.

Key inflation measure shows wholesale prices fell last month | CNN Business Quote:

Quote:

|

||

|

|

|

|

|

#1938 | ||

|

Coordinator

Join Date: Sep 2004

Location: Chicagoland

|

Quote:

Even better. Quote:

You misunderstood me. Some of the 10,000 will be highly-compensated technical workers (developers, architects, etc...). Some of the 10,000 will be not-as-highly-compensated technical (QA testers) and non-technical (marketing people) workers. All of the 10,000 spend money in local economies and low-compensated workers in service industries will suffer a knock-on effect, especially if any of the layoffs are geographically concentrated. Last edited by flere-imsaho : 03-15-2023 at 07:57 PM. |

||

|

|

|

|

|

#1939 | |

|

Coordinator

Join Date: Sep 2004

Location: Chicagoland

|

Quote:

Ten thousand people making an annual average of, say, 500,000, given 26 weeks severance is ~$3B, or 13% of Meta's net profit in 2022. And we're meant to think that's generous. Maybe you do. I don't. |

|

|

|

|

|

|

#1940 |

|

World Champion Mis-speller

Join Date: Nov 2000

Location: Covington, Ga.

|

Come on, guys. Who cares about the people. The stock prices gained 2 dollars.

Sent from my SM-G996U using Tapatalk |

|

|

|

|

|

#1941 | |

|

Head Coach

Join Date: Oct 2005

|

Quote:

Okay, I see your logic now. Let's be glad the Feds came in with the bailout of the depositors otherwise there'll be a lot more out of work. |

|

|

|

|

|

|

#1942 | |||

|

Head Coach

Join Date: Oct 2005

|

Yup, I'd consider this a bank bailout. But don't think the Swiss had any other real choice. CS is the 2nd largest bank in Switzerland behind UBS, and with its global reach, it would have taken (or at least severely hurt) a bunch of others globally and spread the contagion.

https://www.cnbc.com/2023/03/16/cred...ouncement.html Quote:

Quote:

Quote:

Last edited by Edward64 : 03-16-2023 at 07:32 AM. |

|||

|

|

|

|

|

#1943 | |

|

Head Coach

Join Date: Oct 2005

|

This makes sense to me.

Not sure the tiers to use (# of employees, revenue, payroll size etc.) but the $250K guarantee is not enough for some small businesses. Warren says $250,000 cap in deposit insurance for banks should be reexamined | The Hill Quote:

In addition, the Fed has opened up a can of worms. When they guaranteed (and bailed out) the excess deposits over $250K, I would ask why not the rest of us the next time. |

|

|

|

|

|

|

#1944 |

|

Hall Of Famer

Join Date: Jun 2006

Location: Chicago, IL

|

|

|

|

|

|

|

#1945 | |

|

Head Coach

Join Date: Oct 2005

|

It's for like min of 120 days so it is to address any liquidity issue but that's what the Fed is for (the Fed can't guarantee SVB and Signature excess deposits and not do the same for Republic)?

The article didn't mention it but I'm thinking there's some Fed guarantees or a wink-wink to those contributing banks. More details to come out next several days. Stock Chart Icon Quote:

I'm thinking Russia (payback for the sanctions) and China (ours is better than yours) are having a good laugh right now. |

|

|

|

|

|

|

#1946 | ||

|

Head Coach

Join Date: Oct 2005

|

This captures my concern from the post above re: 11 banks bailing out First Republic.

Quote:

Quote:

|

||

|

|

|

|

|

#1947 |

|

Coordinator

Join Date: Nov 2013

|

I'm thinking I should thrown in collard greens with my corned beef this weekend instead of cabbage.

__________________

Paying the Bills with My Mad Programming Skillz |

|

|

|

|

|

#1948 |

|

Head Coach

Join Date: Oct 2005

|

Damn you.

First Republic down -20% today even with the 11 bank bailout. Hopefully the market will steady over the weekend. The Fed (and Joe) will have an anxious weekend. If they let FR fail even with the 11 bank bailout, that could shatter the confidence of the markets. It may be better for them to bailout FR in the truest definition of the word. Dunno. Last edited by Edward64 : 03-17-2023 at 01:22 PM. |

|

|

|

|

|

#1949 |

|

College Starter

Join Date: Oct 2004

|

Disclaimer: I max out my 401k every year.

However, sometimes I wonder if the 401k system isn't just a scam that is going to blow up on my generation. For the past 40 years, there has been more and more money coming into 401ks every pay check, so stocks couldn't help but go up. Advisors have to buy something with it, so demand is there. But now that demographics are changing and boomers are taking money out and 20 year olds can't afford to save much, I don't see how these artificially inflated stocks aren't going to stagnate at best. So I'll continue to buy more stock in my account, but is it really going to grow at an average of 8.7% going forward? There was a reason when company's wanted to get rid of pensions. They saw that it was going to be difficult to get market performance that allowed them to pay those defined benefits, so instead push the responsibility to us. Last edited by bob : 03-19-2023 at 09:02 AM. |

|

|

|

|

|

#1950 | |

|

Hall Of Famer

Join Date: Apr 2002

Location: Back in Houston!

|

Quote:

This has always been my fear, as well. And it's the "conservative" option. Interest rates have basically only gone down since 1980 so it's not like our generation could drop money into a savings account and watch it grow. There's basically no option to stay ahead of inflation that is truly save. Sure, you can diversify your portfolio - put some money into real estate (which also tanks when the market tanks) or commodities (only those markets are heavily manipulated and bubble when the economy goes up and pop when it goes down) or bonds (which are also so intertwined with stocks now). But they all have similar issues. So, yeah, we're all throwing it into Wall Street roulette and hoping it doesn't come up red a few years before you retire. Meanwhile, we keep taking away the guardrails from any investment, all the while our money is also getting skimmed off the top, both when we put it in and take it out, by fast money. SI

__________________

Houston Hippopotami, III.3: 20th Anniversary Thread - All former HT players are encouraged to check it out! Janos: "Only America could produce an imbecile of your caliber!" Freakazoid: "That's because we make lots of things better than other people!" |

|

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

| Thread Tools | |

|

|