|

|

|

#2051 | |

|

Head Coach

Join Date: Oct 2005

|

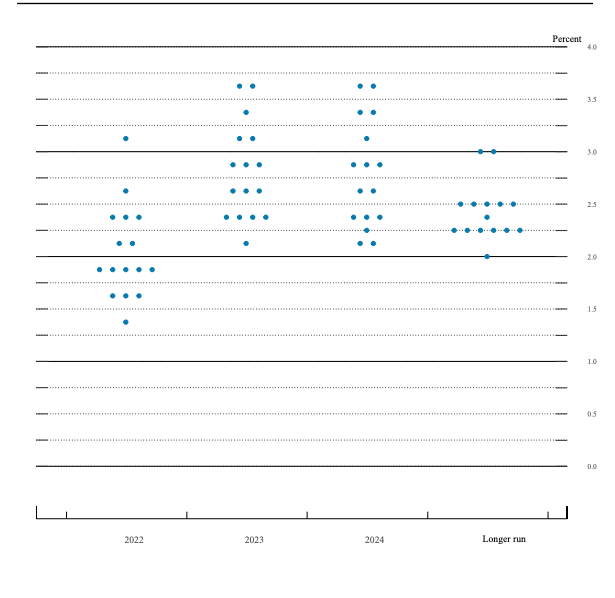

The "Dot Plot" has been in news since yesterday when Jerome paused/skipped the rate hike but the dot plot projected there would be 2 more rate hikes this year.

I may have read about it previously but never paid it much attention until now. For those wondering, see below. I love this tool, provides good info for what the Fed governors are thinking and gives the markets a heads up, fair warning. The Federal Reserve's Dot Plot, Explained | Bankrate Quote:

|

|

|

|

|

|

|

#2052 |

|

Head Coach

Join Date: Oct 2005

|

I have a love/hate relationship with Jerome.

But yeah, he's probably right to publicly reinforce (again) that more rate hikes are likely to come. |

|

|

|

|

|

#2053 | |

|

Head Coach

Join Date: Oct 2005

|

I guess the big banks passing the test is reassuring. No idea how valid the test actually is but assume it's halfway decent and definitely better than nothing.

https://www.cnbc.com/2023/06/28/fed-...recession.html Quote:

|

|

|

|

|

|

|

#2054 | ||

|

Head Coach

Join Date: Oct 2005

|

You go Joe, nice 1Q.

If we go with the traditional definition of 2 consecutive quarters negative growth, this would mean the earliest a recession would be called is Q4 2023. I'm sure parts of the economy is suffering (commercial real estate) but doesn't feel like we're near a recession anytime soon. Quote:

Quote:

|

||

|

|

|

|

|

#2055 | ||

|

Head Coach

Join Date: Oct 2005

|

Quote:

@arles, morningstar had an article worth reading about JEPI. I've bought some in JEPI and JEPQ so getting those articles in my news.google. The Most Successful ETF Launch of All Time Raises Questions | Morningstar Overall, good but cautious. From what I gather, JEPI is doing great now because tremendous inflows (people are investing in it). It also had great 2020 & 2021, whereas 2022 is not as good. If and when that slows down, we'll have to see what happens then. Quote:

|

||

|

|

|

|

|

#2056 | ||

|

Head Coach

Join Date: Oct 2005

|

Great months of May & June, and congrats to Apple for being the first US company to hit $3T and also the biggest company (market cap) in the world.

Quote:

There seems to be less concerns of a recession now with the bigger than expected GDP revision. Inflation seems to be stabilizing some but still the likelihood of at least 2 rate hikes. Quote:

The economy, inflation, markets etc. may just be humming along just in time for Joe. Good times are here again. (Famous last words) |

||

|

|

|

|

|

#2057 | |

|

Head Coach

Join Date: Oct 2005

|

Couple great days with CPI & PPI coming in lower than expected.

Then this guy had to throw cold water over everything. I actually don't disagree with him but couldn't he at least give us a couple days of feeling good before the Jul 26 decision date. Quote:

|

|

|

|

|

|

|

#2058 |

|

Head Coach

Join Date: Oct 2005

|

Not complaining about the markets last week and this week so far.

But everyone knows Jerome is going to raise rates right? And we aren't out of the clear for a recession? Stock tip (with the usual disclaimers): Because my big company ETFs can get boring, I put a little play money into Rocket Labs (RKLB) last week in anticipation of a satellite launch (their 35+ so far) and, for the first time, recovery and reuse of the rocket. The launch & recovery were successful, no news yet on reuse. But it's gone up about 18%+ since last week (so much better than my Bumble at IPO). Do you own research but if you've been wanting to buy into a smaller version of SpaceX, look into RKLB. They won't get as big as SpaceX anytime soon, they are focused on the smaller stuff for now. Last night's launch was from New Zealand and streamed live, you can find it on YT. I remember when NASA announced ending the Shuttle program and said the strategy is to work with commercial firms for space stuff. I thought they were crazy. But 20 years later, here we are. I was wrong, it's worked out pretty well. |

|

|

|

|

|

#2059 |

|

Coordinator

Join Date: Jun 2002

Location: The scorched Desert

|

My portfolio is over up 11% since January and now 9+ % last 12 months. I don't think we will get any major shake ups through years end, and if that maintains I can go more conservative next year

|

|

|

|

|

|

#2060 |

|

Head Coach

Join Date: Oct 2005

|

I tend to agree with you about less chance of negative shakeups and am optimistic about the economy & markets going forward.

We won't enter a formal recession this year (e.g. needs 2 quarters of negative growth). But the biggest fear is Jerome over doing it with rate hikes. 2 more are predicted this year and if he hints at more next year (e.g. sticky inflation), I can believe the markets will take a dive and increase chance of recession. Do think the bank fears are over with now. Congrats to Jerome & SEC in navigating us past that. re: going conservative. There are no guarantees but if your prediction is correct, we are in the first phase/half of a bull market and it should continue. I'm going more aggressive vs conservative. |

|

|

|

|

|

#2061 |

|

Head Coach

Join Date: Oct 2005

|

Nice milestone today. My Zillow home price has fully 100% recovered to its high in early 2022. It dropped to about -17% and then started recovering Feb'ish this year. The combination of house value dropping and the double-dip in the markets in 2022 was depressing.

I know its not a guaranteed sale price, but still nice as a directional indicator. Think I'll celebrate today and get some more Strawberries & Creme Zero. |

|

|

|

|

|

#2062 |

|

This guy has posted so much, his fingers are about to fall off.

Join Date: Nov 2000

Location: In Absentia

|

I haven't checked Zillow in months, but if it is correct, I probably should sell. But I don't think they know what they are doing. They have our house incorrectly listed as a 3/2.5. First, it's 4 bedroom, but they also don't include the basement which has a full bath plus another 1500 sq. ft. of livable (carpeted) space. So really, it should be a 4/3.5 with about 4400 sq. ft. And yet they have my estimate as $50K more than the house behind me that sold 3 months ago with close to the specs that my house should be listed at. None of it makes sense.

__________________

M's pitcher Miguel Batista: "Now, I feel like I've had everything. I've talked pitching with Sandy Koufax, had Kenny G play for me. Maybe if I could have an interview with God, then I'd be served. I'd be complete." Last edited by Ksyrup : 07-20-2023 at 10:43 AM. |

|

|

|

|

|

#2063 |

|

Head Coach

Join Date: Oct 2005

|

When we finished the basement we manually updated the specs. Suggest you do the same

|

|

|

|

|

|

#2064 | |

|

Head Coach

Join Date: Oct 2002

Location: Seven miles up

|

Quote:

You can claim the listing and edit the characteristics for a more accurate listing if you haven't already.

__________________

He's just like if Snow White was competitive, horny, and capable of beating the shit out of anyone that called her Pops. Like Steam? Join the FOFC Steam group here: http://steamcommunity.com/groups/FOFConSteam Last edited by PilotMan : 07-20-2023 at 01:18 PM. |

|

|

|

|

|

|

#2065 |

|

This guy has posted so much, his fingers are about to fall off.

Join Date: Nov 2000

Location: In Absentia

|

That would require creating an account, which I really have no reason to do.

My main point is that they have our house for one less bathroom and one less bedroom and 1500 sq. ft. less space than the house that sold directly behind us for $50K less than Zillow is estimating our house could be sold for. That doesn't give me much confidence in their estimates.

__________________

M's pitcher Miguel Batista: "Now, I feel like I've had everything. I've talked pitching with Sandy Koufax, had Kenny G play for me. Maybe if I could have an interview with God, then I'd be served. I'd be complete." |

|

|

|

|

|

#2066 | |

|

Head Coach

Join Date: Oct 2005

|

Finally here. Wonder what took so long.

https://www.cnbc.com/2023/07/27/regu...big-banks.html Quote:

Nothing on the current FDIC guarantee of $250K. They should definitely increase it for small businesses. I'm okay leaving it at $250K for everyone else (and enforcing it). Individuals with > $250K in a bank account have the resources to spread out the risk. |

|

|

|

|

|

|

#2067 | |

|

World Champion Mis-speller

Join Date: Nov 2000

Location: Covington, Ga.

|

Quote:

|

|

|

|

|

|

|

#2068 |

|

Coordinator

Join Date: May 2002

Location: Jacksonville, FL

|

Regarding this

Appraisals from human appraiser have to be phased out and I may be the last domino to switch to say so I recently had a well known appraiser Say out loud what we’ve suspected which is that they believe that it’s their job to protect the buyers from over paying for homes so they consider that when reviewing versus considering the value of the collateral for the loan which is their only licensed motivation. So now that he’s admitted to affecting the market place and basically being a regulator between buyers and sellers there’s just no choice. They have to go to an automated model that will stick to their lane like us real estate licenses have to. Sent from my iPhone using Tapatalk

__________________

Jacksonville-florida-homes-for-sale Putting a New Spin on Real Estate! ----------------------------------------------------------- Commissioner of the USFL USFL |

|

|

|

|

|

#2069 | ||

|

Head Coach

Join Date: Oct 2005

|

Seems weird to be downgrading right now. I could understand as we were still fighting over the debt ceiling but right now, things are humming somewhat ... or at least, less uncertainty than during the debt ceiling fight.

Fitch downgrades US long-term credit rating to AA+ from AAA | CNN Business Quote:

Quote:

Last edited by Edward64 : 08-01-2023 at 06:01 PM. |

||

|

|

|

|

|

#2070 | |

|

Head Coach

Join Date: Oct 2005

|

Quote:

Dear Apple, I know I've been praying to you a lot to save us. The Fitch & Jerome has really messed things up, so can you do it one more time? I promise I'll be really good and eat my collard greens. |

|

|

|

|

|

|

#2071 | ||

|

Head Coach

Join Date: Oct 2005

|

Good inflation news.

https://www.cnbc.com/2023/08/09/stoc...e-updates.html Quote:

Quote:

I'm tired of inflation, dragged on way too long. Can everybody just stop buying wants (vs needs)? (... with the exception of BG3 & Starfield of course). |

||

|

|

|

|

|

#2072 |

|

College Prospect

Join Date: Oct 2020

|

As with climate change, I appreciate have shifted the blame to consumers as opposed to their need for record profits

|

|

|

|

|

|

#2073 |

|

Coordinator

Join Date: May 2002

Location: Jacksonville, FL

|

This

Sent from my iPhone using Tapatalk

__________________

Jacksonville-florida-homes-for-sale Putting a New Spin on Real Estate! ----------------------------------------------------------- Commissioner of the USFL USFL |

|

|

|

|

|

#2074 | ||

|

Head Coach

Join Date: Oct 2005

|

Quote:

Nvm, I was wrong. Nvidia > Apple Up 9% after market because of their blowout quarter. We'll see if the overall market follows the leader. Jerome is up next Fri from Jackson Hole. Quote:

|

||

|

|

|

|

|

#2075 |

|

World Champion Mis-speller

Join Date: Nov 2000

Location: Covington, Ga.

|

Just an update on our "is Zillow acurate?" evergreen question. Just had an assessment done for a second mortgage, the assessment was $8k higher than Zillow.

|

|

|

|

|

|

#2076 | |

|

Head Coach

Join Date: Oct 2005

|

Quote:

I assume $8k is an acceptable difference to you? e.g. no idea what that is a % of. I checked today and we've exceeded the high from last year. A somewhat funny story. We got our property taxes and, no surprise, it went higher. Wife and I talked about appealing it to see if we can get it lower. She researched on the county FB and learn that others tried appealing but their property taxes went higher after the process. So we decided not to appeal. |

|

|

|

|

|

|

#2077 | |

|

Head Coach

Join Date: Oct 2005

|

Yup, true to form, the markets react positively to Jerome's speech but as he continues talking, it turns red. It "burns" but keep acting like the adult in the room and tell it the way it is.  https://www.cnbc.com/2023/08/25/fed-...s-further.html Quote:

|

|

|

|

|

|

|

#2078 | |

|

World Champion Mis-speller

Join Date: Nov 2000

Location: Covington, Ga.

|

Quote:

|

|

|

|

|

|

|

#2079 |

|

Head Coach

Join Date: Oct 2005

|

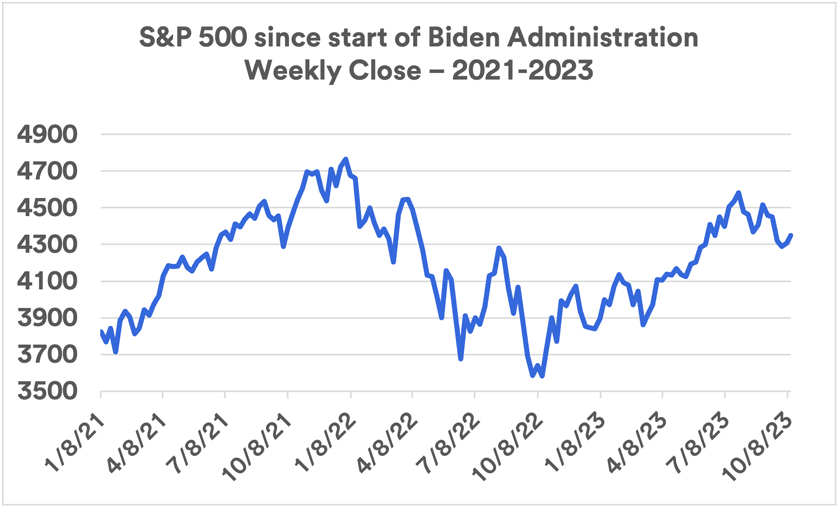

I can confirm this.

How the stock market’s performance under Biden is worse than under Obama or Trump — in one chart - MarketWatch  Article is kinda sloppy and incomplete. Better if they also show S&P, Dow & Nasdaq comparisons. Still hope for Biden but he's behind the curve. Last edited by Edward64 : 08-25-2023 at 05:30 PM. |

|

|

|

|

|

#2080 |

|

This guy has posted so much, his fingers are about to fall off.

Join Date: Nov 2000

Location: In Absentia

|

Coincidence or not that the Fed continues to push for interest rates to stay higher, longer, with Goldman Sachs suggesting a fed rate cut likely wouldn't happen until 4th quarter of 2024 - conveniently around (or after) the election takes place? Seems like everything economically is stacking up against Biden.

In what ways can the President - any President - actually influence the price of goods in the grocery store? Because that seems to be what's primarily feeding the negativity - despite pretty good economic numbers, actual prices we pay are largely remaining high, so people don't see (or care) about economic indicators of a good economy. A piece of a larger puzzle, of course, but one of the most important.

__________________

M's pitcher Miguel Batista: "Now, I feel like I've had everything. I've talked pitching with Sandy Koufax, had Kenny G play for me. Maybe if I could have an interview with God, then I'd be served. I'd be complete." |

|

|

|

|

|

#2081 |

|

lolzcat

Join Date: Oct 2000

Location: Annapolis, Md

|

it's the grocery store, stupid

|

|

|

|

|

|

#2082 |

|

Grizzled Veteran

Join Date: Nov 2013

|

Don't forget about gas prices too.

__________________

"I am God's prophet, and I need an attorney" |

|

|

|

|

|

#2083 |

|

This guy has posted so much, his fingers are about to fall off.

Join Date: Nov 2000

Location: In Absentia

|

Or the price of whiskey at the Newark airport. You choose.

__________________

M's pitcher Miguel Batista: "Now, I feel like I've had everything. I've talked pitching with Sandy Koufax, had Kenny G play for me. Maybe if I could have an interview with God, then I'd be served. I'd be complete." |

|

|

|

|

|

#2084 | |

|

Head Coach

Join Date: Oct 2005

|

Quote:

Joe can't directly influence grocery prices but indirectly he can influence (supply chain issues, transportation costs etc.). But is that 80% of the price increases or 20% ... probably more like 5%. IMO the big ticket item is overall inflation. Grocery stuff is just once piece of CPI. Yeah, grocery prices are going to ding him, but (fair or not) so is gas prices, home prices, car prices etc. If overall inflation is tamed, grocery prices will follow. But he is running out of time. |

|

|

|

|

|

|

#2085 | ||

|

College Starter

Join Date: Jun 2001

Location: The Dirty

|

But most of this is made up, right? I keep hearing that profits for most of these companies are soaring...so it would appear that capitalism is at odds with inflation. So is it inflation, or are there just perceptions that are being used by companies to jack up prices on everything.

Quote:

Quote:

All this and my Kroger usually has 1 lane open that is manned, and 10 self-checkouts that have long lines and no room for anything but a few items.

__________________

Commish of the United Baseball League (OOTP 6.5) |

||

|

|

|

|

|

#2086 |

|

Coordinator

Join Date: May 2002

Location: Jacksonville, FL

|

This

Sent from my iPhone using Tapatalk

__________________

Jacksonville-florida-homes-for-sale Putting a New Spin on Real Estate! ----------------------------------------------------------- Commissioner of the USFL USFL |

|

|

|

|

|

#2087 |

|

Pro Starter

Join Date: Feb 2003

Location: PDX

|

In hindsight seems like some (more) price-gouging, profit-limiting regulations would have been useful, at least on some targeted sectors like groceries. Instead we have legislation making it practically illegal for publicly traded companies to do anything other than maximize profits, and this is the obvious result.

__________________

Last edited by thesloppy : Today at 05:35 PM. Last edited by thesloppy : 09-22-2023 at 03:37 PM. |

|

|

|

|

|

#2088 |

|

College Starter

Join Date: Jun 2001

Location: The Dirty

|

It's not inflation folks, it's capitalism. Pull yourselves up by the bootstraps and make more money.

__________________

Commish of the United Baseball League (OOTP 6.5) |

|

|

|

|

|

#2089 |

|

Hall Of Famer

Join Date: Jun 2006

Location: Chicago, IL

|

It's not inflation, it's greed. These companies are making a killing. There's very little Joe can do to change things unless he wants to build a time machine and somehow stop QE or other actions taken over the past decade. Although nominating Powell for another term was horrendous.

That shouldn't let him off the hook though. A lot of the conditions that have led to this are things he supported happening in the Senate and as Vice President. |

|

|

|

|

|

#2090 |

|

Coordinator

Join Date: Sep 2004

Location: Chicagoland

|

Publix's effective tax rate in 2022 was, apparently, 9.31%.

|

|

|

|

|

|

#2091 |

|

Head Coach

Join Date: Oct 2005

|

Thank you Jerome for not crashing the markets this month.

|

|

|

|

|

|

#2092 |

|

Grizzled Veteran

Join Date: Nov 2013

|

The stock market is looking good in pre-trading today due to good inflation data.

October CPI report: Stock futures surge, Treasury yields drop after subdued inflation data

__________________

"I am God's prophet, and I need an attorney" |

|

|

|

|

|

#2093 |

|

Head Coach

Join Date: Oct 2005

|

Yeah, I saw that. And perfect timing for the holiday season.

Joe's stock market performance in past 3 years has been abysmal. Hopefully, reduced inflation and no more Fed increases will help him in the "It's the grocery store/prices" category. How's your Lean FIRE plans coming along? |

|

|

|

|

|

#2094 |

|

Grizzled Veteran

Join Date: Nov 2013

|

Dating has kind of derailed those plans for the moment.

__________________

"I am God's prophet, and I need an attorney" |

|

|

|

|

|

#2095 |

|

Coordinator

Join Date: Sep 2004

Location: Chicagoland

|

Honestly, we'd know exactly when I was retiring right now if it wasn't for the unbelievable variability in college costs.

Well, plus our extremely low risk tolerance. There's definitely a world where I could be retired now. Check with me in a year. |

|

|

|

|

|

#2096 | |

|

Head Coach

Join Date: Oct 2005

|

And futures points to the party continuing. Hoping we get back to the 2 days up, 1 day down cadence.

Quote:

FWIW, since my last post about Zillow, house price has not changed which is unusual. It's still higher than last year's high and maybe dropped a tad from this year's high, so still very happy with the theoretical worth. Currently 2 houses for sale in our 400+ house subdivision which is better than last year. Wonder if the stability means we've finally reached the new normal equilibrium where prices will now return to increasing 2-3-4% a year. Last edited by Edward64 : 11-15-2023 at 09:15 AM. |

|

|

|

|

|

|

#2097 | ||

|

Head Coach

Join Date: Oct 2005

|

I'm thinking ChatGPT made an ooopsies and Microsoft has come out ahead.

https://www.cnbc.com/2023/11/20/oust...ella-says.html Quote:

Quote:

|

||

|

|

|

|

|

#2098 |

|

This guy has posted so much, his fingers are about to fall off.

Join Date: Nov 2000

Location: In Absentia

|

I've been seeing a number articles suggesting an improvement in prices and stocks recently. One was the CEO of Wal-Mart suggesting price deflation coming soon, and another was that with signs that inflation is retreating and the Fed possibly holding off on more increases, that in similar historical situations, the market has increased around 14% in the year following the last rate hike. I sure hope both of those things happen.

__________________

M's pitcher Miguel Batista: "Now, I feel like I've had everything. I've talked pitching with Sandy Koufax, had Kenny G play for me. Maybe if I could have an interview with God, then I'd be served. I'd be complete." |

|

|

|

|

|

#2099 |

|

Head Coach

Join Date: Oct 2005

|

Specific to Fed & inflation, from what I've read, very good chance the Fed is done with increasing rates (unless there is a major CPI/PPI surprise) which is good for the markets. The real questions are (1) when will the Fed start to decrease rates and (2) will we have a soft landing or will we slip into a recession.

I really hope 2024 will be a banner year. It'll go a long way to helping Joe. Stock market under Biden | U.S. Bank  Last edited by Edward64 : 11-20-2023 at 02:39 PM. |

|

|

|

|

|

#2100 | |

|

Head Coach

Join Date: Oct 2005

|

Let's really hope rate of inflation is down for good (at least for this cycle). It's be good for the economy/markets to get back to normal for Joe in 2024.

Fed’s Beige Book finds economy has slowed — and so has inflation - MarketWatch Quote:

|

|

|

|

|

|

| Currently Active Users Viewing This Thread: 4 (0 members and 4 guests) | |

| Thread Tools | |

|

|