|

|

|

#1151 |

|

Head Coach

Join Date: Oct 2005

|

Nice rally yesterday and futures are solidly up this morning, thank you Tech stocks. To simplify and rebalance for next year, I exchanged some MF, ETF, stocks for S&P 500 index.

At this stage of my life, the theory is some sort of bond allocation. But I'm pretty much all in on stocks. Looking forward to a great 2022 market. |

|

|

|

|

|

#1152 |

|

Head Coach

Join Date: Oct 2005

|

Crazy to think S&P 500 is up 29% YTD.

|

|

|

|

|

|

#1153 | |

|

Head Coach

Join Date: Oct 2005

|

Pelosi's husband has bought a bunch of call options (must be nice to have so much disposable income to "roll the dice"). Basically, he is positive on the markets/economy.

Pelosi's husband bought Google, Disney call options that would pay off if bull market continues - MarketWatch Quote:

|

|

|

|

|

|

|

#1154 |

|

Head Coach

Join Date: Oct 2002

Location: Seven miles up

|

Funny how every single new market record meant the economy was booming trump, but how many did we have this year?

__________________

He's just like if Snow White was competitive, horny, and capable of beating the shit out of anyone that called her Pops. Like Steam? Join the FOFC Steam group here: http://steamcommunity.com/groups/FOFConSteam |

|

|

|

|

|

#1155 |

|

Head Coach

Join Date: Oct 2005

|

Nice start to the year.

|

|

|

|

|

|

#1156 | |

|

Head Coach

Join Date: Oct 2005

|

I hope she gets the book thrown at her.

https://www.cnn.com/2022/01/03/tech/...ict/index.html Quote:

|

|

|

|

|

|

|

#1157 |

|

World Champion Mis-speller

Join Date: Nov 2000

Location: Covington, Ga.

|

Isn't it interesting she was found guilty of fraud on investors, but not the charges of fraud on the patients? It is almost as if the laws are written to protect big money and not consumers.

Sent from my SM-G996U using Tapatalk |

|

|

|

|

|

#1158 |

|

Resident Alien

Join Date: Jun 2001

|

Rough day for the stock markets.

|

|

|

|

|

|

#1159 |

|

Grizzled Veteran

Join Date: Nov 2013

|

Did something happen at 2:00pm to cause the markets to sink?

__________________

"I am God's prophet, and I need an attorney" |

|

|

|

|

|

#1160 |

|

Head Coach

Join Date: Oct 2005

|

The Fed said something implying less support and possibly quicker than expected. I think 3 interest rate hikes. Growth stocks (e.g. tech) are getting hit because higher interest rates would (theoretically) mean less/slower growth than what was already priced in. Also, I think it means the Fed sees inflation as possibly a "real" problem and needs to fight it. I'm still heavily into the big tech growth stocks/funds (go Apple!). I think they'll continue to do okay. I'm out of the more speculative ones and moved quite a bit to boring S&P Index fund in Dec. I am somewhat overweight negative right now on the markets 1H 2022 (but definitely don't short the markets because of me!). We'll still be struggling with inflation and significant supply chain issues this year ... it comes down to are they trending better, or still stuck in a quagmire and/or still trending down. |

|

|

|

|

|

#1161 |

|

Grizzled Veteran

Join Date: Nov 2013

|

I am not liking this year so far.

__________________

"I am God's prophet, and I need an attorney" |

|

|

|

|

|

#1162 |

|

Favored Bitch #1

Join Date: Dec 2001

Location: homeless in NJ

|

Not a big crypto guy but the sportsbook I use pays out in bitcoin. Thinking of putting 10K into bitcoin hoping it goes back up to 60K. That would net me 5K currently.

|

|

|

|

|

|

#1163 |

|

Head Coach

Join Date: Oct 2005

|

|

|

|

|

|

|

#1164 |

|

Head Coach

Join Date: Oct 2005

|

Another ouch of a day.

I'm overweight on tech & growth funds/ETFs, and looks like Nasdaq is taking more of a hit relatively speaking so I'm wincing. The theory is higher interest rates hurt growth companies more. I'm all for increasing rates though. As I understand it, rates need to go up so the Fed has a viable weapon to use when economy needs a boost. The rates are so low now so not as much of ammo. There's an article that ponders on risk of stagflation - economy slows down while inflation increases. Last time that happened was in the 70's so no real experience dealing with the realities of that. EDIT: and futures this morning is looking fugly Last edited by Edward64 : 01-14-2022 at 08:24 AM. |

|

|

|

|

|

#1165 |

|

Mascot

Join Date: Dec 2010

|

The truth is, you really need to be heavily invested in blue chippers as a long term investor. It's pretty much the only bonafide way to ensure you can sleep at night. lol

|

|

|

|

|

|

#1166 |

|

Mascot

Join Date: Dec 2010

|

What the market needs is more republican representation in the federal government...as you can imagine, the uncertainty of where things are going is what creates much of the volatility. You may agree or disagree with my assessment, but just remember "perception is reality". That's just the truth of the world we live in.

|

|

|

|

|

|

#1167 |

|

Coordinator

Join Date: Sep 2004

Location: Chicagoland

|

For the sake of argument, let's consider the past 40 years, on the basis that (IMO) retail investing really took off for the first time in the 1980s and, perhaps more importantly, the last 40 years are more relevant to present day than, say, the 50 years following the Great Depression.

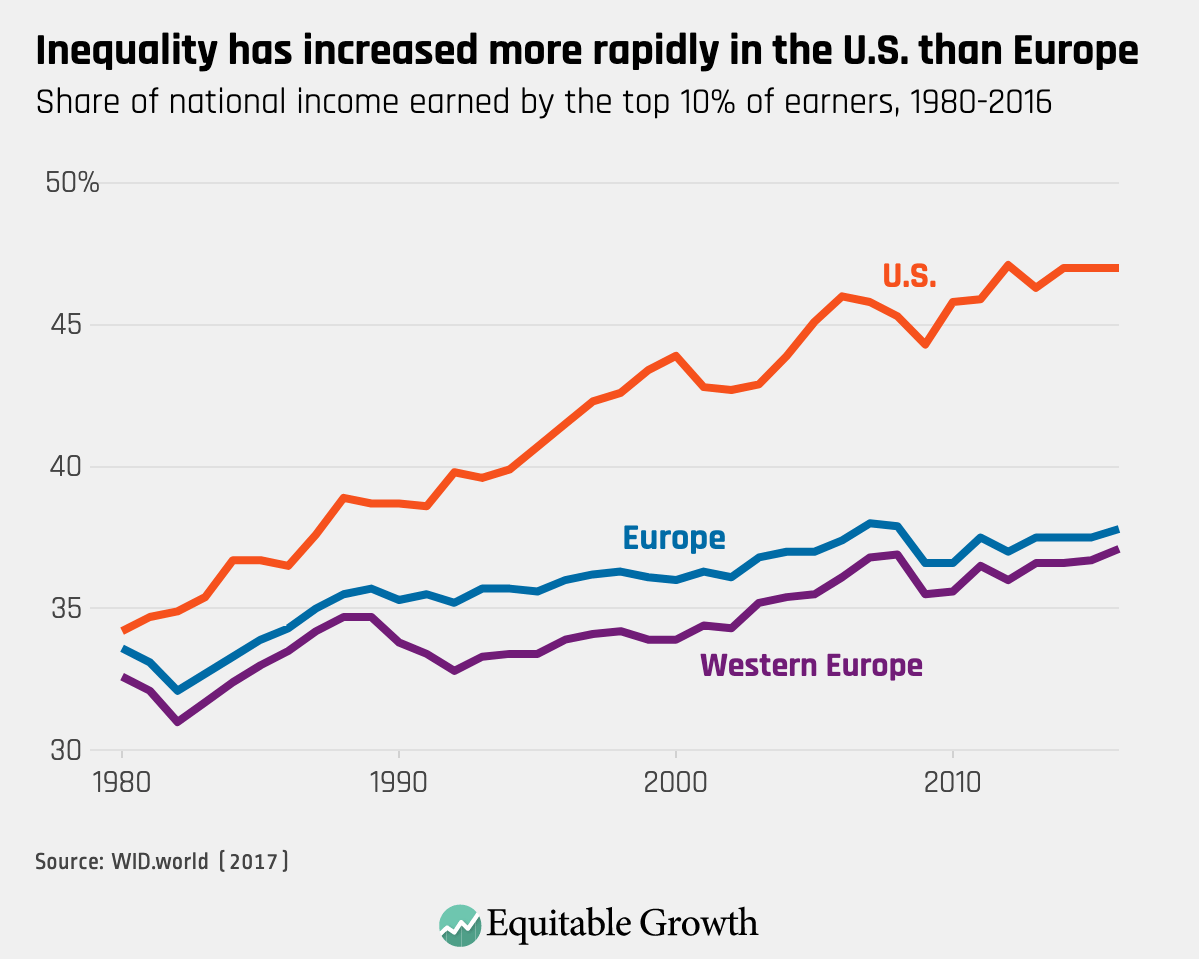

Source If we look at Presidents with 8 year terms in that period, we have: Clinton: 228.9% Obama: 148.3% Reagan: 147.3% GW Bush: -26.5% If we look at Presidents with 4 year terms and also performance of the 2 term Presidents in their first 4 years, we have: Clinton: 105.8% Obama: 73.2% Trump: 50.9% GHW Bush: 43.1% Reagan: 35.8% GW Bush: -3.7% Superficially, we could probably conclude from the above data that Democratic Presidents are unambiguously good for the stock market. In reality, I think the narrative is more likely: 1. Reagan's deregulation and tax cuts led to a lot more money looking for investment, and this drove a historic rise in the stock market's value. 2. Clinton, as we know, adopted a pretty laissez-faire approach to economic issues (actually, IMO, pretty much all issues after the failures of his first year in office), so this run continued. 3. The bubble finally popped in 2001 (and recall, there were significant pullbacks before 9/11, so you can't blame 9/11 alone). 4. Bush tried to solve the above by doubling down on Reagan/GOP orthodoxy, which succeeded only in creating another bubble (housing) and a catastrophic crash in 2008. 5. Recovery began with TARP (passed mainly with Democratic votes, a majority of Republicans voted against) & ARRA (no GOP votes in the House, only 3 GOP votes in the Senate) under Obama but really gathered steam and was extended by the Fed pumping money into the economy (again, all that money needs to be invested somewhere). 6. Volatility increased under Trump, and before COVID the market rose ~40%, but with some serious pullbacks along the way and concern over, again, over-valuation (i.e. "bubble"). While I personally think Democratic economic policies are better for the economy & stock market in the long-term, especially as opposed to GOP "cut taxes and non-defense spending" orthodoxy (termed "voodoo economics" by Republican President George H.W. Bush), I think an objective conclusion on the above is that the politically schizophrenic approach to economic policy endemic to American politics creates an unavoidable boom-and-bust cycle that generally only favors the already-wealthy:  |

|

|

|

|

|

#1168 | |

|

Coordinator

Join Date: Sep 2004

Location: Chicagoland

|

Quote:

The way I understand it (and the way I look at it from an investing standpoint) is that there's been a lot of money out there looking to be invested, due to things like tax cuts and the Fed pumping money into the economy. As an example, I read just the other day where Andressen Horwitz just raised $3B for new investment funds (which you know will be going into tech). This investment money is looking for growth, which is why you see those stocks, especially, soaring (i.e. Nasdaq). You are correct that higher interest rates hurt growth companies more. The reason for this is that these growth companies will be taking advantage of low interest rates to leverage themselves and use that money for growth, be it investment, M&A, etc.... If higher interest rates are being telegraphed, then of course interest in those stocks will pull back. I personally think this hits tech companies more because their price-to-earnings ratios tend to be pretty aggressive since investors are investing more on the basis of expected future vs. current earnings (note that the bubble run-ups are usually characterized by price-to-earnings ratios getting out of whack). And indeed tech companies' earning presentations often emphasize this concept strongly. I'm not sure how you fix this. Venture funds seem perfectly fine to throw money at business models which do not seem at all sustainable (WeWork) or are downright fraudulent (Theranos), in part because venture funds can have 20 failures offset by one wild success. And the market follows the venture funds (at least for tech), compounding the problem. I suppose we could require greater scrutiny around projections and restrictions around some of the more aggressive practices such as high-frequency trading and leveraged buyouts, but I'm not convinced placing more nanny controls on the market itself will pay dividends, so to speak. Plus, it's probably politically untenable. Perhaps better to assume the wild & crazy capitalism comes with its share of fallout, and a compact between the market and the rest of society needs to be forged whereby better supports are put in place to save the common person from the fallout of spectacular failures (e.g. all the people laid off by the WeWork collapse, including the ancillary businesses supporting that model; all the people laid off when leveraged buyouts end up in bankruptcy, etc...). Put differently, if we want to preserve the ability of the 1% to take economic risks, we should require (say, through taxes & better social supports) a societal cushion for those who didn't sign up for a high-risk, high-reward economy. |

|

|

|

|

|

|

#1169 |

|

Head Coach

Join Date: Oct 2002

Location: Colorado Springs

|

I'm getting murdered today in the market.

|

|

|

|

|

|

#1170 |

|

This guy has posted so much, his fingers are about to fall off.

Join Date: Nov 2000

Location: In Absentia

|

Someone hacked crypto.com and stole $15M in ether which is being laundered through Tornado Cash and will almost certainly never be recovered due to the anonymous nature of blockchain transactions.

Fortune favors the brave, indeed.

__________________

M's pitcher Miguel Batista: "Now, I feel like I've had everything. I've talked pitching with Sandy Koufax, had Kenny G play for me. Maybe if I could have an interview with God, then I'd be served. I'd be complete." |

|

|

|

|

|

#1171 |

|

Resident Alien

Join Date: Jun 2001

|

Well played, sir.

|

|

|

|

|

|

#1172 | |

|

Head Coach

Join Date: Oct 2005

|

Yup. Refuse to look at portfolio right now until we start going back up. Quote:

|

|

|

|

|

|

|

#1173 | |

|

Head Coach

Join Date: Oct 2000

Location: North Carolina

|

Quote:

It's like the guys who steal from drug dealers because they can't call the police. |

|

|

|

|

|

|

#1174 |

|

Head Coach

Join Date: Oct 2005

|

Woohoo.

Nasdaq is now in correction territory, got that over with. |

|

|

|

|

|

#1175 |

|

Grizzled Veteran

Join Date: Nov 2013

|

That seems so long ago...

__________________

"I am God's prophet, and I need an attorney" |

|

|

|

|

|

#1176 | |

|

Head Coach

Join Date: Oct 2005

|

Keep the faith ... Quote:

|

|

|

|

|

|

|

#1177 |

|

Head Coach

Join Date: Oct 2005

|

Two days in a row where markets were up nicely and went red. Don't see any news yet why the downturn today.

|

|

|

|

|

|

#1178 |

|

Hall Of Famer

Join Date: Nov 2002

Location: Newburgh, NY

|

I didn't realize that Bitcoin has dropped almost 50% since early November. Hope everybody here is safe.

__________________

To love someone is to strive to accept that person exactly the way he or she is, right here and now.. - Mr. Rogers |

|

|

|

|

|

#1179 |

|

Grizzled Veteran

Join Date: Nov 2013

|

It's still up over 18% since last year.

__________________

"I am God's prophet, and I need an attorney" |

|

|

|

|

|

#1180 |

|

Head Coach

Join Date: Oct 2005

|

Painful as the Nasdaq correction is, glad I got out of GBTC. That Bitcoin stuff was too stressful for me.

This past week sucked. Looking forward to the next one. |

|

|

|

|

|

#1181 |

|

College Prospect

Join Date: Sep 2005

|

Absolutely wrecked lmao.

Only bright point is I took profits around the highs in both crypto and stocks so about 20% cash. Feels a little worrisome going shopping with the Russians parked on the Ukraine border. Bitcoin, Tesla and Google on my watch list. |

|

|

|

|

|

#1182 |

|

Head Coach

Join Date: Oct 2005

|

Please sir, may I have another ...

|

|

|

|

|

|

#1183 |

|

Favored Bitch #1

Join Date: Dec 2001

Location: homeless in NJ

|

Just made the mistake of checking my portfolio. Ouch.

|

|

|

|

|

|

#1184 | |

|

Head Coach

Join Date: Oct 2005

|

The market gods heard you and granted you a boon. What a day. Quote:

Last edited by Edward64 : 01-24-2022 at 04:27 PM. |

|

|

|

|

|

|

#1185 |

|

Grizzled Veteran

Join Date: Nov 2013

|

I'm actually thinking about putting some money into Bitcoin. Please talk me out of it.

__________________

"I am God's prophet, and I need an attorney" |

|

|

|

|

|

#1186 |

|

Resident Alien

Join Date: Jun 2001

|

Go ahead. Throw your money away!

|

|

|

|

|

|

#1187 |

|

Coordinator

Join Date: Sep 2004

Location: Chicagoland

|

It's like blackjack without the foolproof jbmagic method and where the dealer can just take all your money and walk away at any time.

|

|

|

|

|

|

#1188 | |

|

Grizzled Veteran

Join Date: Nov 2013

|

Quote:

You just said the jbmagic words right there.

__________________

"I am God's prophet, and I need an attorney" |

|

|

|

|

|

|

#1189 | |

|

Hall Of Famer

Join Date: Apr 2002

Location: Back in Houston!

|

Quote:

Buying on margin, baby! How can that go wrong? SI

__________________

Houston Hippopotami, III.3: 20th Anniversary Thread - All former HT players are encouraged to check it out! Janos: "Only America could produce an imbecile of your caliber!" Freakazoid: "That's because we make lots of things better than other people!" Last edited by sterlingice : 01-24-2022 at 09:34 PM. |

|

|

|

|

|

|

#1190 |

|

Head Coach

Join Date: Oct 2005

|

See wallstreetbets It's incredible how much some of these guys lose ... and proudly proclaim it. I don't know how they live with the stress for their puts/calls and margin stuff. |

|

|

|

|

|

#1191 | |

|

Head Coach

Join Date: Oct 2005

|

Quote:

I assume you want Bitcoin as a possible get-rich quick scheme? I'd go the slow but sure route. Consistent contributions to your 401k or IRA over a long period of time and let compound returns do a lot of work for you. You may not get your Lambo but you should be in good shape for retirement. Last edited by Edward64 : 01-24-2022 at 10:08 PM. |

|

|

|

|

|

|

#1192 |

|

Head Coach

Join Date: Oct 2005

|

Just a thought about this depressing market.

I recalibrated my portfolio in Dec. I moved more in S&P 500 but am still IMO overweight in tech stocks/mutual funds/ETFs etc. I haven't looked at my portfolio recently (admittedly a fair weather person, only when market is going up). But I've been able to sleep and haven't been tempted to bailout on any of my investments ... because I know even though they are down now, high confidence they will recover over time. Now if I still have GBTC or Bumble or SPCE (all 50+% losses from highs last year), I would be sweating ... and tomorrow futures are down  |

|

|

|

|

|

#1193 | |

|

Hall Of Famer

Join Date: Apr 2002

Location: Back in Houston!

|

Quote:

I've become acquainted with them as I've read reddit a bit more than past couple of years. That's, um, not my way to do things. Those folks do things a bit different. SI

__________________

Houston Hippopotami, III.3: 20th Anniversary Thread - All former HT players are encouraged to check it out! Janos: "Only America could produce an imbecile of your caliber!" Freakazoid: "That's because we make lots of things better than other people!" Last edited by sterlingice : 01-24-2022 at 10:25 PM. |

|

|

|

|

|

|

#1194 | |

|

Hall Of Famer

Join Date: Jun 2006

Location: Chicago, IL

|

Quote:

I don't think there is anything wrong with putting some extra cash in a high risk, speculative asset. Maybe it goes up to $100k and you make out like a bandit. Maybe it drops to $10k. Just as long as you treat it as a risk and are not using money you need. If you want to be talked out of it, there is 100+ years of history that shows investing in a boring index fund will provide you with a nice return in the long run. I prefer boring because I prefer not adding a new stressor to life. |

|

|

|

|

|

|

#1195 | |

|

College Prospect

Join Date: Sep 2005

|

Quote:

I am still very bullish on Bitcoin, despite its recent crash. It is slowly but surely gaining traction. The recent approval of a futures ETF and confirmation from the SEC that it is not in its crosshairs gives it that solid foundation that it never had previously. I just don't think the digital generation will buy gold, they will buy Bitcoin and various other crypto assets. Gold's $12 trillion market cap is just going to slowly but surely get eaten away in the long term. Or perhaps it just stays flat like it has the last 10 years and inflation continues to eat away at the capital investers put in. Maybe not over the next 6 months if they are risk off times, but down the road and over the long term. If Bitcoin can grab just 20% of that gold market cap to its $680 billion market cap it breaks $100k. I see them as comparable assets in many ways. Bitcoin is just a new and improved version of gold. It will become less volatile as the market cap grows IMO. My biggest concern for Bitcoin is that money will go in to other crypto assets which have smaller market caps, which give the possibility of far greater returns. Layer 1 protocols have been growing rapidly the past year or, so lined up to take Ethereum's market share. I have small holdings in Solana, Fantom and Cardano, which have worked out well and are still up significantly from this time last year. But all things considered I see Bitcoin as a safer bet. It has a set supply unlike those holdings I mentioned, or gold, or the dollar for that matter. I see that as a huge advantage. I have found taking profits absolutely key in crypto. Enter with a plan and don't let greed or fear change your plan. Simply buying the fear and selling the greed has served me well. Crypto Fear & Greed Index - Bitcoin Sentiment - Alternative.me The established institutions will try and scare people away from Bitcoin as it is a threat to their strangle hold. But the price charts speak for themselves. Yes, its volatile. But it's rising strongly over the long term and it appears further regulation is not the threat it was. |

|

|

|

|

|

|

#1196 |

|

Favored Bitch #1

Join Date: Dec 2001

Location: homeless in NJ

|

I have invested a decent amount in to Bitcoin the last 6 weeks or so and plan to hold. A buddy put me on to Cardano. Thinks by 2030 it will be worth close to 1K. Not sure it will be that much, but hell, even it it goes to $50-$100 I would have an insane amount of money.

I do a lot of sports betting and my site pays out in crypto, so whenever I have a decent night I pull out between $500-$5000 and just park it in crypto, usually bitcoin. IF the bitcoin goes up I make additional money as opposed to just leaving it in an offshore account. I also bought some Dogecoin because why not. |

|

|

|

|

|

#1197 | |

|

Pro Starter

Join Date: Feb 2003

Location: PDX

|

Quote:

Who the hell is speculating on crypto prices 8 years from now??

__________________

Last edited by thesloppy : Today at 05:35 PM. |

|

|

|

|

|

|

#1198 |

|

Favored Bitch #1

Join Date: Dec 2001

Location: homeless in NJ

|

|

|

|

|

|

|

#1199 |

|

Pro Rookie

Join Date: May 2002

Location: Prairie du Sac, WI

|

I bought a bunch of Cardano when it was $0.10. $1000 seems quite a stretch given the supply, but I certainly wouldn’t complain.

I’ve been more disciplined through this crypto bull run, just DCAing Bitcoin and buying small chunks of ether here and there. Might be time to start doing a little more, as the Reddit Crypto group’s rate of panic posts are pretty high these days. A good buy sign. If everybody’s happy and talking about it, sell! Or stop buying. |

|

|

|

|

|

#1200 | |

|

Hall Of Famer

Join Date: Apr 2002

Location: Back in Houston!

|

Quote:

My dumbest hurdle to buying crypto is I'm not sure how to even start - like getting a wallet, etc. SI

__________________

Houston Hippopotami, III.3: 20th Anniversary Thread - All former HT players are encouraged to check it out! Janos: "Only America could produce an imbecile of your caliber!" Freakazoid: "That's because we make lots of things better than other people!" |

|

|

|

|

|

| Currently Active Users Viewing This Thread: 5 (0 members and 5 guests) | |

| Thread Tools | |

|

|