|

|

|

#2001 |

|

Head Coach

Join Date: Oct 2005

|

Is renting cheaper?

I know in some areas it makes more sense to own nowadays. |

|

|

|

|

|

#2002 | ||

|

Head Coach

Join Date: Oct 2005

|

Glad to see the saga end, hope this is the last of the contagion. Let's have Elizabeth Warren do her thing with regulations.

SVB --> Signature --> Credit Suisse --> First Republic https://www.cnbc.com/2023/05/01/firs...k-failure.html Quote:

PSA: was wondering which bank may be next. From a CNN article on Mar 16, FRC was identified. And after it ... Quote:

Last edited by Edward64 : 05-01-2023 at 10:38 AM. |

||

|

|

|

|

|

#2003 | |

|

Head Coach

Join Date: Oct 2005

|

I love how Apple is getting into this business. I can see them forcing traditional banks to be much more competitive in interest rates.

Wife and I checked on interest we were earning at WellsFargo and it was literally peanuts compared to Apple's 4+%. We got the no-fee AppleCard, signed up for the savings plan. We'll be moving our 6-month emergency fund into Apple over the next month, WellsFargo loss. Done through GS and there is the FDIC $250K guarantee. Quote:

Our main knocks against current Apple Savings are: 1) There is no way to create a joint savings plan. We're uncomfortable having all our emergency fund just under one person so we both got a card & savings setup and will split 50-50. Not having this feature is weirdThe biggest knock is: 4) No way to withdraw cash easily via ATM. We are keeping our WellsFargo accounts so we can use the ATM. IMO Apple can really do some really, really serious damage if they also get into the checking account business with debit cards.There are some other internet only banks out there that provide more % and more services. In retrospect we should have explored those years ago. But the Apple brand and the simplicity (application and approval in minutes on a weekend) were the main driver. Bottom-line. I think the smaller banks are really going to get hurt. I think Apple has found a great new revenue stream, especially if they get into the ATM/checking account business. Last edited by Edward64 : 05-02-2023 at 09:59 AM. |

|

|

|

|

|

|

#2004 |

|

Resident Alien

Join Date: Jun 2001

|

I think our Discover savings account is at 3.75% interest (or something in that ballpark) if you want a more traditional banking option.

|

|

|

|

|

|

#2005 |

|

Head Coach

Join Date: Oct 2005

|

Hey thanks, didn't know.

Wife has a Discover but we never really thought about exploring other services it offers. |

|

|

|

|

|

#2006 | ||

|

Head Coach

Join Date: Oct 2005

|

Quote:

Spoke too soon. Looks like PacWest is next up. Quote:

|

||

|

|

|

|

|

#2007 |

|

World Champion Mis-speller

Join Date: Nov 2000

Location: Covington, Ga.

|

Paypal is paying 4.15% on their saving accounts.

|

|

|

|

|

|

#2008 |

|

Hall Of Famer

Join Date: Jun 2006

Location: Chicago, IL

|

Taxpayers going to need to bailout half the banks in this country again it seems. What an industry.

First Republic bailout last week to PacWest this week I'm guessing. |

|

|

|

|

|

#2009 |

|

Hall Of Famer

Join Date: Apr 2002

Location: Back in Houston!

|

But don't worry, larger banks will get to gobble them up for pennies on the dollar and, in exchange, there will be significantly less competition going forward and worse terms and rates for consumers.

SI

__________________

Houston Hippopotami, III.3: 20th Anniversary Thread - All former HT players are encouraged to check it out! Janos: "Only America could produce an imbecile of your caliber!" Freakazoid: "That's because we make lots of things better than other people!" |

|

|

|

|

|

#2010 | |

|

Head Coach

Join Date: Oct 2005

|

Yeah, Jerome is going to raise rates again today. Leisure & Hospitality again is the leader.

https://www.cnbc.com/2023/05/03/adp-...pril-2023.html Quote:

|

|

|

|

|

|

|

#2011 | ||

|

Head Coach

Join Date: Oct 2005

|

Yup, Jerome is the debbie downer (again) but the adult in the room. The markets were up initially but as he continued to talk, they went down.

Only Apple earnings (Thu) can save us now. Apple expected to announce buybacks and dividend increases. Quote:

Quote:

Must be nice to have so much cash on hand. Just for kicks, looked up what $90B can buy. Companies ranked by Market Cap - page 2 Gilead $100B Allianz $97B BlackRock $96B CVS Health $89B ADP $89B Citigroup $89B EssilorLuxottica $88B (eye wear? WTF) Charles Schwab $87B Mercedes-Benz $81B British American Tobacco $81B Volkswagen $76B |

||

|

|

|

|

|

#2012 | |

|

World Champion Mis-speller

Join Date: Nov 2000

Location: Covington, Ga.

|

Quote:

|

|

|

|

|

|

|

#2013 |

|

Hall Of Famer

Join Date: Jun 2006

Location: Chicago, IL

|

PacWest just plummeted after hours. It looks like they are toast. This just hours after Powell said things were strong.

|

|

|

|

|

|

#2014 | |

|

Head Coach

Join Date: Oct 2005

|

Charles Schwab came up as possibly vulnerable (but not as bad as PACW or WAL).

I'm not a CS client (yet) but do have a brokerage at TDAmeritrade which was bought by CS. My TD account will be swapped over weekend of May 26. Not particularly worried, know its insured by SIPC and I'm far below the limit. I figure the worse that will happen is my funds will be frozen for a short period of time. If below is true, we'll continue to have angst until around next Fed meeting on Jun 13-14. Stock Chart Icon Quote:

Last edited by Edward64 : 05-04-2023 at 12:35 AM. |

|

|

|

|

|

|

#2015 |

|

Head Coach

Join Date: Oct 2005

|

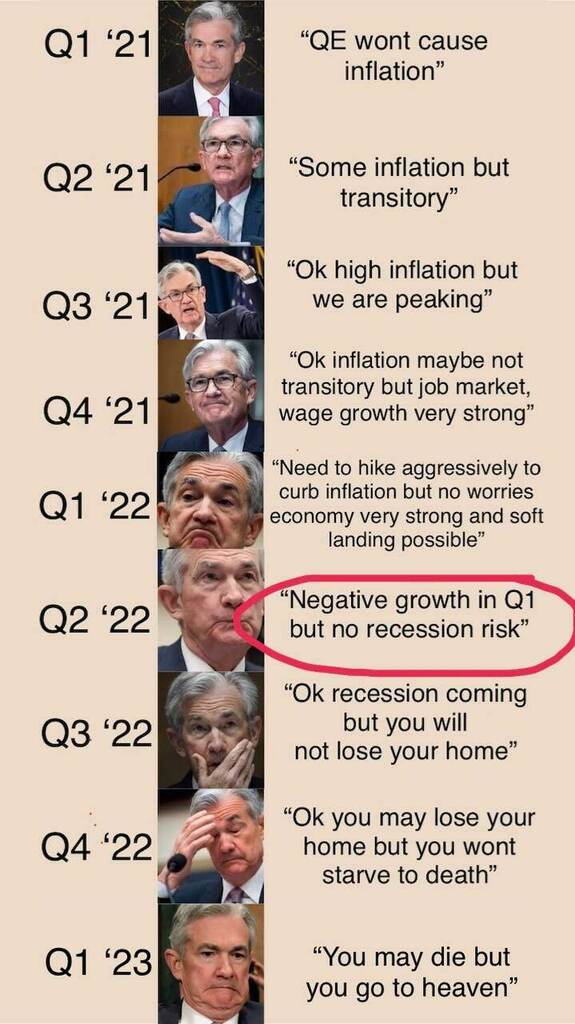

This meme is making the rounds.

Inaccurate but funny (e.g. Q1 did not have negative growth)  Last edited by Edward64 : 05-04-2023 at 12:18 AM. |

|

|

|

|

|

#2016 |

|

Hall Of Famer

Join Date: Apr 2002

Location: Back in Houston!

|

The poors were starting to have some wage growth. We couldn't have that now

SI

__________________

Houston Hippopotami, III.3: 20th Anniversary Thread - All former HT players are encouraged to check it out! Janos: "Only America could produce an imbecile of your caliber!" Freakazoid: "That's because we make lots of things better than other people!" |

|

|

|

|

|

#2017 | ||

|

Head Coach

Join Date: Oct 2005

|

Quote:

... and Apple comes through again. Up +4.6%. Forbes had an interesting stat below. I think you have to offset this stat with how much they lost last year also (article didn't have that, but suspect they lead the way in losses). But yeah, these Tech giants lead the way up/down. These 7 Tech Stocks Command Almost 90% Of The S&P 500’s Gains—Signaling Market Rally May Not Be So Healthy Quote:

|

||

|

|

|

|

|

#2018 | ||

|

Head Coach

Join Date: Oct 2005

|

Different place, different time. Interesting, didn't know about pre-Volcker situation.

Jerome missed back in 2021, not good for his legacy if he prematurely stops and inflation comes back. Premarket stocks: The Fed could be on the verge of repeating its 1970s mistake | CNN Business Quote:

Quote:

|

||

|

|

|

|

|

#2019 | |

|

Head Coach

Join Date: Oct 2005

|

Couldn't read the article through the paywall but the headlines make sense to me. I guess this is one big reason why my house has appreciated so much in the past 3 months (per Zillow).

St Louis Fed says current 30 year fixed average is 6.39% which is lower than the 6.75% we got back in the early 2000's. 30-Year Fixed Rate Mortgage Average in the United States (MORTGAGE30US) | FRED | St. Louis Fed My neighbor, who sold for less than asking last month, should have waited. Homeowners’ Low Mortgage Rates Mean Few Are Selling - WSJ Quote:

Last edited by Edward64 : 05-10-2023 at 01:14 PM. |

|

|

|

|

|

|

#2020 |

|

Head Coach

Join Date: Oct 2000

Location: North Carolina

|

There's some interesting game theory, I think, regarding the debt ceiling.

Investors don't want the US to default on its debt and spark a global recession. And they are assuming that it isn't going to happen b/c they have not started a massive sell off. But a massive sell off is the kind of thing that might actually light a fire under the White House/Congress and get them to make a deal. So by acting like a default won't happen, they make a default more likely to happen. |

|

|

|

|

|

#2021 | |||

|

Head Coach

Join Date: Oct 2005

|

Some history lessons in the 2011 debt ceiling "game of chicken".

https://www.cnbc.com/2023/05/09/what...investors.html Quote:

Quote:

Quote:

|

|||

|

|

|

|

|

#2022 | |

|

Head Coach

Join Date: Oct 2005

|

Don't know what Anheuser-Busch should do to right the ship with falling sales. Reading MSM, it doesn't seem they have a strategy other than stay quiet, help distributors with challenges, and hope this fades.

It may well fade away in the long run but I'd come up with a plan that takes steps vs ignoring-and-hoping-it-goes-away. I suspect whatever they come up with will isolate one group or the other, but better than isolating both (like what's happening now). I'm sure this will be a business school case study sometime. https://www.cbsnews.com/news/bud-lig...lvaney-impact/ Quote:

|

|

|

|

|

|

|

#2023 | |

|

Head Coach

Join Date: Oct 2005

|

Get her ass in jail. Enough of pregnancies & delays.

Former Theranos CEO Elizabeth Holmes Puts Off Prison Once Again – NBC Bay Area Quote:

|

|

|

|

|

|

|

#2024 |

|

Head Coach

Join Date: Oct 2005

|

Overall, a pretty good week for my overweighted tech portfolio. Started tracking my portfolio more diligently again that markets are going up vs down. So not near as depressing.

Nasdaq has significantly outgained the Dow and S&P 500 this year. I'm approx. back to where I was in Aug 2022 but still about -15% down from my portfolio high in Feb 2022. Zillow house price has continued to appreciate (I think it's going up at a faster pace in 2023 than it did in 2021-2022!!) and up +4.8% in past 30 days. I'm now about -3% from the high, so recovered nicely. Yes, I know that Zillow may not be accurate but do think it shows a trend, just glad it doesn't seem house prices will crash after its rapid rise. So overall, doing much better than the hell hole that was 2Q, 3Q and 4Q 2022. Let's hope debt ceiling gets done next week; inflation comes in lower and Jerome doesn't see the need to raise rates in June; banks continue to stabilize; and earnings week come in within range of expectations. PSA. There are 2 ETFs that have caught my eye. JP Morgan's JEPI and JEPQ. Do your own research but they currently pay over 10+% in dividends. Their portfolio are pretty established companies and they use options to max dividends, lower downside risks but also lowers upside gains. I would have told you 10+% dividends is suspicious but more knowledgeable people at r/dividends/ are fans. They are for people looking at dividend income + a little growth vs pure growth + small dividends. Last edited by Edward64 : 05-20-2023 at 10:19 AM. |

|

|

|

|

|

#2025 |

|

Grey Dog Software

Join Date: Nov 2000

Location: Phoenix, AZ by way of Belleville, IL

|

I am doing a small free substack on my dividend portfolio I have been building. My goal is a collection of ETF/ETN/close end funds to generate between 15 and 20% a year in dividends. By avoiding individual companies, it shouldn't have the earnings risk and big capital swings. Right now the dividend yield is 16%, Shameless plug here, I've only listed two of the investments so far. May plan is to have all listed an my portfolio by the end of May:

https://arlie.substack.com Again, it's more for me to eventually track progress and get feedback from people there and on twitter. Like I said, it's free so take a gander. JEPQ will be in the portfolio. My current yield on cost is close to 15%. It's a solid way to get exposed to growth (biggest holdings are MSFT, AAPL, GOOG, AMZN, NVDA). It sells covered call options against the holdings to generate income (which is what it uses to pay the monthly dividend). The nice thing is you don't have to pay taxes if the shares get called away (like you were doing the covered calls yourself). The upside is a little limited with the calls sold, but you also get a nice dividend if we hit another bump in the market. Last edited by Arles : 05-20-2023 at 01:26 PM. |

|

|

|

|

|

#2026 |

|

Head Coach

Join Date: Oct 2005

|

Thanks, I'll have to read your blog.

Yes, I am attracted to JEPQ also because of high quality big tech names. I'm not as comfortable with the JEPI names but they seem decent enough. r/dividends warns there's not long enough of a track record to really know how either will perform or how low the dividend payout will go. Supposedly they will do well in a status quo or slightly down market. SCHD & VDIGX are significants holding for me, and their dividend yield are 3.75% and 1.5%. I figure I'll put maybe 10-15% of my portfolio into JEPQ, JEPI for the 10+% dividend and see how it goes. |

|

|

|

|

|

#2027 |

|

Grey Dog Software

Join Date: Nov 2000

Location: Phoenix, AZ by way of Belleville, IL

|

JEPQ and JEPI have variable dividends which means they will increase as the share price does. So it’s better to DCA than make a lump purchase as the shares are a little pricey now. The annualized dividends tend to be 12-15% so buying over time should work out.

|

|

|

|

|

|

#2028 | |||

|

Head Coach

Join Date: Oct 2005

|

We need Elizabeth Warren (or whoever) to really check this out. Not quite as bad as NINJA loans but only 1% down makes me worried.

Home buyers will now be able to put down 1% on their home, Rocket Mortgage says - MarketWatch Quote:

Quote:

Quote:

Last edited by Edward64 : 05-22-2023 at 04:00 PM. |

|||

|

|

|

|

|

#2029 | |

|

Coordinator

Join Date: Sep 2004

Location: Chicagoland

|

Quote:

BWHAHAHAHAHAHAHAHAHAHAHAHA |

|

|

|

|

|

|

#2030 |

|

Head Coach

Join Date: Oct 2005

|

Thank you Nvidia (and Apple) for your fantastic earnings and futures up +2% because of it.

You have the potential to be the next Apple stock (but your current PE ratio is already 175 even before today's futures +25%). Now if only the Dems & GOP can get their act together, and put the debt ceiling crisis to bed. |

|

|

|

|

|

#2031 | |

|

Head Coach

Join Date: Oct 2005

|

So maybe no pause after all.

Investors are losing hope for a Fed pause and bracing for another interest-rate hike instead. Here's what 8 experts have predicted. Quote:

|

|

|

|

|

|

|

#2032 | ||

|

Head Coach

Join Date: Oct 2005

|

Economy does not want to be tamed.

https://www.cnn.com/business/live-ne...omy/index.html Quote:

But unemployment rate increased because of reduced self-employment. Wonder what that means? Quote:

Last edited by Edward64 : 06-02-2023 at 09:08 AM. |

||

|

|

|

|

|

#2033 |

|

Head Coach

Join Date: Oct 2005

|

Apple is doing great so far in anticipation of their AR/VR announcement today.

I'm thinking the markets are irrationally exuberant and are a little too hyped up on a product that will be limited appeal immediately with its $3K price tag. But I do hope they eventually out-meta Meta because Apple (so far) is the better run company and I definitely want to be a Ready Player One metaverse before I die. Last edited by Edward64 : 06-05-2023 at 01:17 PM. |

|

|

|

|

|

#2034 |

|

World Champion Mis-speller

Join Date: Nov 2000

Location: Covington, Ga.

|

Now Apple is down a full 1%. Someone took the jump as an opportunity to dump?

Sent from my SM-S916U using Tapatalk |

|

|

|

|

|

#2035 |

|

Head Coach

Join Date: Oct 2005

|

Apple was at it's recent high, up +2% just before it started and started going down during the day.

The goggles are priced at $3,500 which is higher than the expected $2,500-$3,000; also early 2024 and think many were hoping in time for this holiday season. I'm guessing reality is setting in that there won't be much monetization anytime soon. Reading some reviews, it does seem to offer more potential than the Meta goggles. |

|

|

|

|

|

#2036 |

|

Head Coach

Join Date: Oct 2000

Location: North Carolina

|

|

|

|

|

|

|

#2037 |

|

hates iowa

Join Date: Oct 2010

|

$3500 eh? Does it come with a couple nights stay in that Star Wars hotel? I'm surprised the stock didn't drop more

Sent from my CPH2451 using Tapatalk |

|

|

|

|

|

#2038 |

|

Hall Of Famer

Join Date: Jun 2006

Location: Chicago, IL

|

The Hololens already exists and I don't think it did too well for Microsoft. Apple can dress up tech and have a strong following which will likely lead to better sales. But I just don't know who's interested in wearing that around all day. Kind of the same thing with VR and 3D TVs. Cool tech but comfort trumps all.

Then again, I thought the iPad would bomb so take that with a huge grain of salt. |

|

|

|

|

|

#2039 |

|

Head Coach

Join Date: Oct 2005

|

Check it out. Pretty cool presentation, I can definitely see potential.

https://www.youtube.com/watch?v=TX9qSaGXFyg It's too bulky right now but I'm sure it'll get more streamlined. |

|

|

|

|

|

#2040 |

|

Head Coach

Join Date: Oct 2000

Location: North Carolina

|

Chinese exports down 7.5% in May--way more than expected.

I'm thinking this could go in this thread, or the Biden thread, or the COVID thread. Certainly not an advertisement for having tried to go zero-COVID. Also have to wonder how the CCP will do. Authoritarian regimes can survive if you are giving the people jobs and money. Much harder to keep the masses sated without growth. |

|

|

|

|

|

#2041 | |

|

Head Coach

Join Date: Oct 2005

|

A nice milestone, supposedly we are in a bull market now ... but not sure it's worth much with all the headwinds.

S&P500 highest close was about 4,766 vs 4,293 today. So still down about -10%. Quote:

|

|

|

|

|

|

|

#2042 | |

|

Head Coach

Join Date: Oct 2005

|

Today's CPI is as expected and looks like the pause is on. Let the new Bull market begin!

https://www.cnbc.com/2023/06/13/cpi-...may-2023-.html Quote:

Wonder if my previously $12 entree that went up to $18 will come back down some as inflation recedes. Pretty sure I know the answer and now just have to accept the new normal pricing. |

|

|

|

|

|

|

#2043 | |

|

College Starter

Join Date: Oct 2000

Location: Pittsburgh, PA

|

Quote:

Deflation is probably worse than inflation.

__________________

"It's a great day for hockey" - "Badger" Bob Johnson |

|

|

|

|

|

|

#2044 | ||

|

Head Coach

Join Date: Oct 2005

|

Maybe the pandemic did do a little good to shift mindsets.

Just some context on what perception of "wealthy" is. Who do Americans consider wealthy? Plain old millionaires just don't cut it anymore. - MarketWatch Quote:

Quote:

And another graphic The referenced survey details are here Access Denied and Wealth Is More Than Money | Charles Schwab Last edited by Edward64 : 06-13-2023 at 11:33 AM. |

||

|

|

|

|

|

#2045 | |

|

Head Coach

Join Date: Oct 2005

|

I don't know if its worse but I definitely believe unrestrained inflation/deflation is definitely very, very bad. But yeah, I wouldn't want my home value to decrease significantly. Nor people's paychecks etc. On the other hand, it would be good if restaurant, average car sale price, groceries etc. went down some. I've read some articles that China is experiencing some deflation. I know there were deflationary periods in my lifetime but they weren't memorable to me. So how it's playing out in China should be interesting as a 3rd party observer. China's factory deflation steepens as demand wanes | Reuters Quote:

|

|

|

|

|

|

|

#2046 |

|

Head Coach

Join Date: Oct 2002

Location: Seven miles up

|

It's much, much worse.

__________________

He's just like if Snow White was competitive, horny, and capable of beating the shit out of anyone that called her Pops. Like Steam? Join the FOFC Steam group here: http://steamcommunity.com/groups/FOFConSteam |

|

|

|

|

|

#2047 |

|

Grizzled Veteran

Join Date: Nov 2013

|

I'm actually hoping again I can retire early!

__________________

"I am God's prophet, and I need an attorney" |

|

|

|

|

|

#2048 |

|

Head Coach

Join Date: Oct 2005

|

Unfortunately, "hope" is not a very good retirement strategy

|

|

|

|

|

|

#2049 | |

|

Head Coach

Join Date: Oct 2005

|

Quote:

A little more on China's problems (of which deflation is a symptom). A good read. From a Cold War 2 point of view, I sure hope it is true. It'll be good for them to have a "lost decade" or two (like Japan) to restructure/transform. As a realist who has heard that China's bubble will pop for the past 15+ years, I'll believe it happens. China's Economy Is Imploding. That's a Problem for US, Wall Street. |

|

|

|

|

|

|

#2050 |

|

Grizzled Veteran

Join Date: Nov 2013

|

It's not a good strategy for dating either. I might have to look into your Asian women "dating" service.

__________________

"I am God's prophet, and I need an attorney" |

|

|

|

|

| Currently Active Users Viewing This Thread: 6 (0 members and 6 guests) | |

| Thread Tools | |

|

|